How a data warehousing solution helped a financial organisation extracting more value from data

Organizations providing financial services face a seemingly uphill task to keep their data governance and planning efforts moving at the pace of business. They need to centralize the data from several data sources to achieve accurate, actionable reporting on various financial areas including deals, borrowing, and underwriting. Most of these organizations find their existing infrastructure outdated and may realise that it is no longer capable of managing the increased information analysis demands.

Customer Background

Customer Background Requirement

Requirement Scope

Scope Solution

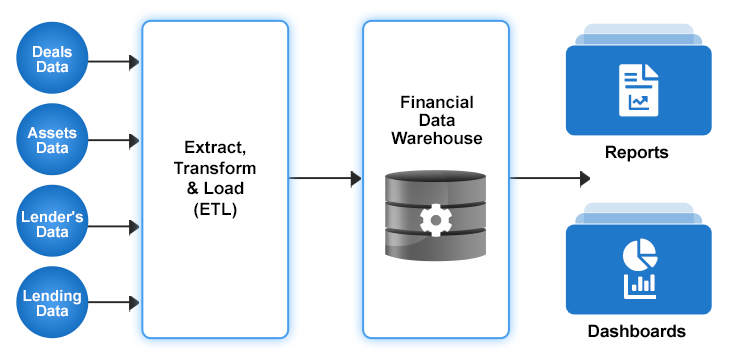

Solution

Business Benefits

Business Benefits